|

29 January 2018

Posted in

sentix Euro Break-up Index News

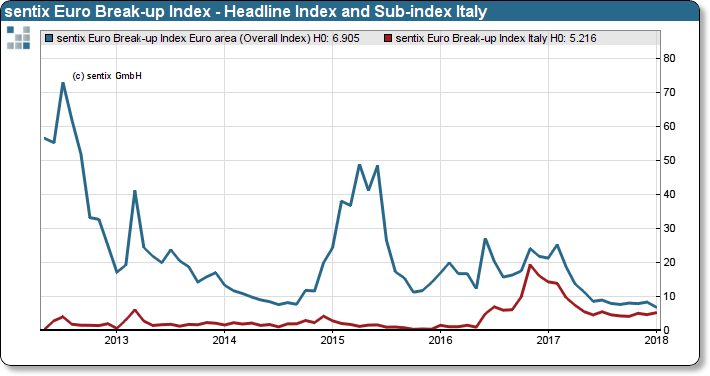

At the beginning of 2018, the euro zone is still in robust shape. As in the past few months, only a few investors are expecting major unrest in the euro zone. In January 2018, the overall index even fell to a historic low of 6.9%! If you want to look out for possible problem areas, the focus will naturally be on Italy. The forthcoming parliamentary elec-tions are a source of uncertainty. The Italian sub-index is rising against the general trend.

At the beginning of 2018, the euro-zone is more robust than ever since sentix launched its Euro Break-up Index. The headline index for the euro-zone falls to 6.9%, an all-time low! It is impressive that apart from Italy and Greece, no other southern countries have a more than 1% chance of leaving the euro area. Finland is currently the third highest contributor with 1.0%, followed by Germany (0.9%) and Cyprus (0.7%).

sentix Euro Break-up Index: Headline Index Euro area and Sub-index Italy

The trend of the last few months thus continues. When looking for possible problem areas, the focus is on Italy. Con-trary to the general trend, the sub-index here rises to 5.22%. Italy thus remains the country which, from the investors' point of view, is the most likely to be regarded as a candidate for exit from the euro. We are expecting these concerns to increase until the election, similar to what happened before the Brexit vote.