|

20 July 2015

Posted in

Special research

sentix Commodities Sentiment collapses in July and reaches a new all-time low. The past has shown that when such a strong fall of the indicator occurs it is not wise to buy the market anti-cyclically. The time for contrarians will come when confidence returns.

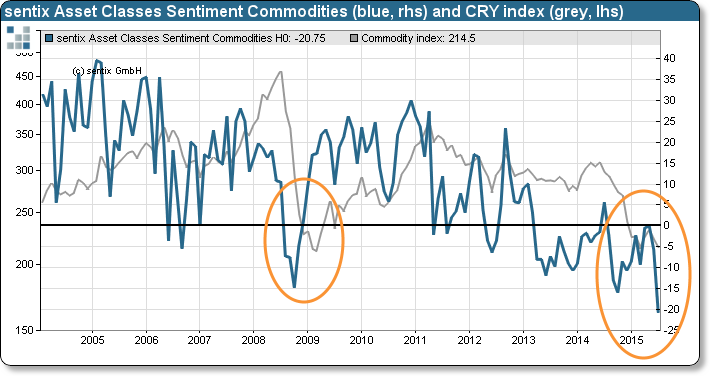

Against the backdrop of falling commodities prices sentix Asset Classes Sentiment for commodities drops by 15 percentage points to -20.75 points, a new all-time low. Even after the collapse of the US investment bank Lehman Brothers in 2008 and also during the strong fall in crude-oil prices in the second half of last year the mood among investors was better than at the current juncture (see graph).

A worsening sentiment cannot only be observed for the asset class of commodities as a whole but also for different of its segments. Further sentix data shows, for instance, that crude-oil sentiment recedes strongly. For gold investors lower their thumbs as well – among market participants the fear emerges that the entire sector is in a free fall. This stance towards commodities leaves its traces in the emerging markets universe, too, for which investors become significantly more cautious. From an anti-cyclical point of view such an extreme pessimism represents a contrarian buying opportunity. But the experiences made in 2008/09 and 2014/15 teach us that here an investment becomes beneficial only after several months (see again graph). One thus can expect more selling to follow until the contrarian effect materialises.