|

28 September 2015

Posted in

sentix Euro Break-up Index News

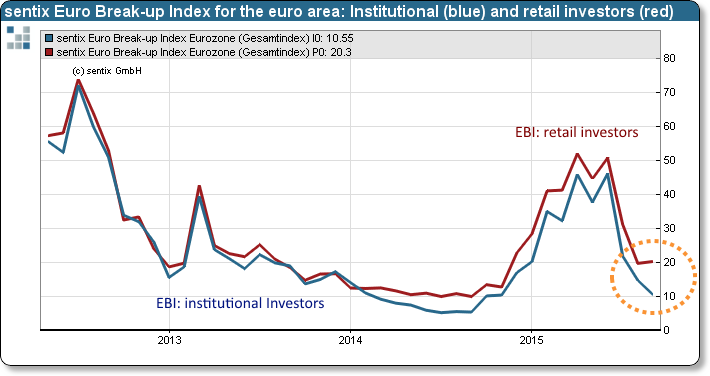

For the third time in a row the sentix Euro Break-up Index (EBI) falls and stands now at 15.4% after 17.2%. The development is routed in – especially institutional – investors’ perception about Greece. This signals further opportunities for Greek government bonds.

In the aftermath of Alexis Tsipras confirmation as prime minister in the early elections, the sentix EBI for September decreases again. However, this month’s opinion about the likelihood of a euro break-up is split between institutional and individual investors: while the opinion of retail investors remains unchanged in comparison to the previous result, institutional investors significantly lower their expectations again (see chart below).

The development the EBI highlights for the entire euro-area is reflected in Greece’s national EBI as well. After 15.9% previously, the Index recedes to 12.8%, whereof the index for institutional investors falls nearly 6 percentage points to only 8.2% – its lowest reading since last October. For the remaining so-called “PIIGS” countries (Italy, Spain, Portugal and Ireland) each EBI falls below 1%. Only for Cyprus investors are still slightly more concerned, expressing a value of 1.5% (after 2.3%). However, this is the lowest reading since inception of the EBI. Overall, the indicators signal a significant ease in terms of a euro break-up.

These ease-of-tension signals should especially boost potential for Greek government bonds. Firstly, the EBI drops for Hellas more than for any other country. Secondly, the fact that institutional investors continue to lower the odds for a “Grexit” even enhances the EBI signal. Institutional investors’ expectations usually precede those of individual ones.

Background

The sentix Euro Break-up Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Break-up Index can be found on: http://ebr.sentix.de.

This month’s reading of 15.4% means that currently this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012, and touched its low at 7.6% in July 2014.

The current poll in which 999 individual and institutional investors participated was conducted from September 24 to September 26, 2015.