|

31 October 2017

Posted in

sentix Euro Break-up Index News

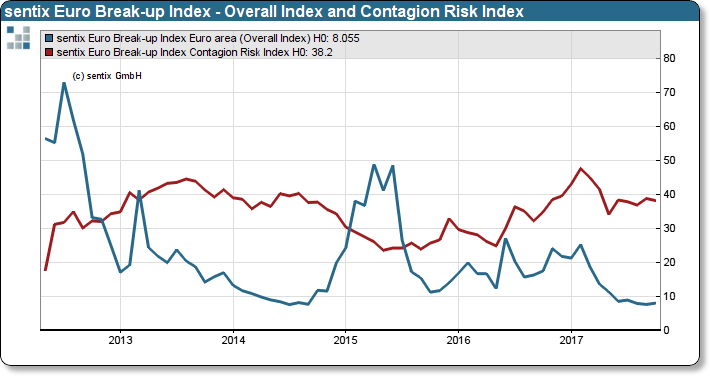

The probability of a break-up of the Eurozone measured by the sentix euro break-up index has slightly increased in October. It rose by 0.4 percentage points to 8.1%. This slight increase is quite surprising in view of the unrest in Spain. The Spanish sub index has even fallen from 0.9% to 0.6%. A little more concern for investors is Austria. The foreseeable participation of the FPÖ in the government has contributed to an increase in the sub index of Austria in the last two months from under 0.3% to more than 0.8%.

Spain has plunged into a veritable constitutional crisis. The independence efforts in Catalonia and the dismissal of the regional government provide news. But investors are keeping this development cold with a view to the cohesion of the Eurozone. The clear backing of the EU and all Community countries, as well as the behavior of many companies to turn their backs on Catalonia, leaves no doubt for investors. The Spanish sub index in the sentix EBI is surprisingly de-clining in October! Nevertheless, the probability of a break-up of the Eurozone has risen to 8.1%.

sentix Euro Break-up Index: Headline Index Euro area and contagion risk index (left scale)

This is due to slight increases in the sub-indices for Greece and Cyprus. However, these are not new trends, but un-certainties resulting from the measurement methodology. Overall, the EBI remains close to its historical lows. The Eu-rozone currently appears to be relatively stable.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 8.06% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 7.61% in July 2014.

The current poll in which about 1.000 institutional and retail investors participated was conducted from October 26th to October 28th, 2017.