|

27 December 2017

Posted in

sentix Euro Break-up Index News

The euro-zone ends 2017 in a stable state. Although the regional elections in Catalonia did not bring about any change in the status quo of Catalonia's autonomy issue, investors see no reason to draw negative conclusions for the euro zone. The sentix Euro Break-up Index rose only marginally from 7.91% to 8.35%. The sub-index for Spain rose from 0.63% to 1.24%. That's not a critical level yet.

The elections to the regional parliament in Catalonia did not create a fundamentally new majority. However, the re-sulting uncertainty about how things will continue in Spain leaves investors cold. The sentix Euro Break-up Index rises only slightly to 8.35%.

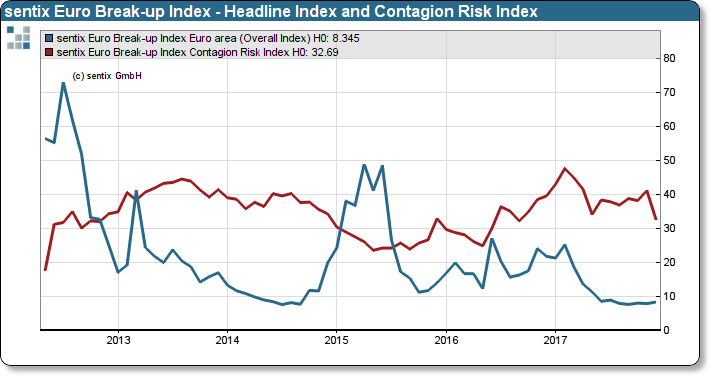

sentix Euro Break-up Index: Headline Index Euro area and Contagion Risk Index

The trend of the last few months thus continues. The eurozone leaves 2017 in a stable constitution, as evidenced by the contagion risk index. This sub-index falls to its lowest level of the year in December. According to this indicator, the risk of infection is low if investors' risk assessment is spread over as few countries as possible.

Greece and Italy are still the countries with the highest EBI values. In both cases, however, these are less than 5%. Spain comes in third, but despite a doubling this month, the Spanish EBI is only 1.24%.

Background

The sentix Euro Breakup Index is published on a monthly basis and was launched in June 2012. Its poll is running for two days around the fourth Friday of each month. Results are regularly published on the following Tuesday morning. Survey participants may choose up to three euro-zone member states of which they think they will quit the currency union within the next twelve months. Further details on the sentix Euro Breakup Index can be found on http://ebr.sentix.de.

This month’s reading of 8.35% means that currently, this percentage of all surveyed investors expect the euro to break up within the next twelve months. The EBI has reached its high at 73% in July 2012 and touched its low at 7.61% in July 2014.

The current poll in which about 1.000 institutional and retail investors participated was conducted from December 21st to December 23rd, 2017.