Special survey on European elections: Risks for EUR-USD and refinancing conditions of the periphery!

|

28 April 2014

Posted in

Special research

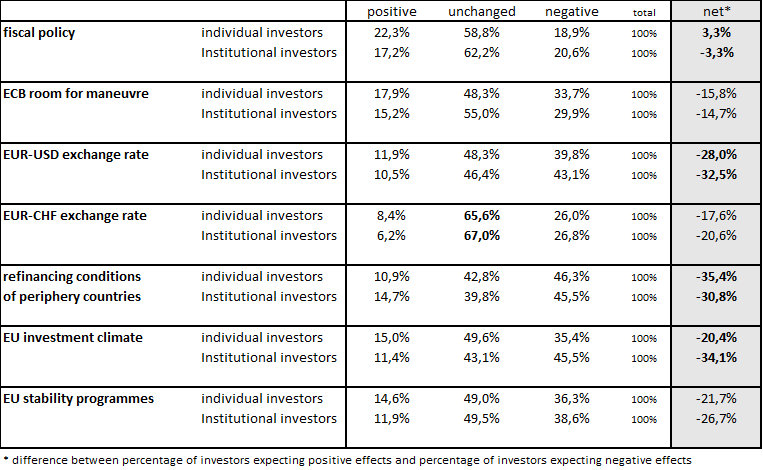

As the European elections between May 22nd and May 25th are approaching, sentix has set up a special survey on the topic. In this survey we have asked investors what impact on several capital markets issues they would expect to have a large success of Europe-critical parties in these elections (survey running from April 24 to April 26, 922 participants). Here, we present and discuss the results of the survey.

The largest impact is seen by investors on the refinancing conditions of the so-called periphery countries. Here, a net of approximately 35% of individual investors and a net of about 31% of institutional investors expect that refinancing problems of these euro countries will (again) aggravate in the aftermath of such an electoral outcome (for the definition of "net", please see table below). In addition, investors think that the EUR-USD exchange rate will come under pressure. Overall they foresee a significant worsening of the investment climate in the EU. For EUR-USD, against which also the longer-term interest rate differentials weigh currently, such an outcome could serve as the trigger for a pronounced weakness. At the same time, the periphery bond rally should then come to an end.

Regarding the influence on fiscal policy investors clearly disagree. Those who expect a negative impact, almost equal in number those who expect a positive impact. This result is probably caused by the fact that Europe-skeptical forces vary a lot across Europe, also as far as their fiscal policy stance is concerned. That should be why the answers to this topic appear so diverse, too.

Furthermore, it is noteworthy that a large portion of investors think the EUR-CHF exchange rate will stay unaffected by a significant strengthening of anti-European parties: two thirds of investors believe that such an event will not cause the EUR-CHF exchange rate to alter – although they clearly see a weaker EUR-USD in that case. Consequently, the guarantee of the Swiss National Bank to keep the EUR-CHF exchange rate above the level of 1,20 is a highly credible one in the eyes of market participants.

The original question in special survey was: "What impact do you expect on the following themes if Europe-critical parties have a major elections victory in the forthcoming European elections?" The results are the following: