|

24 August 2015

Posted in

Special research

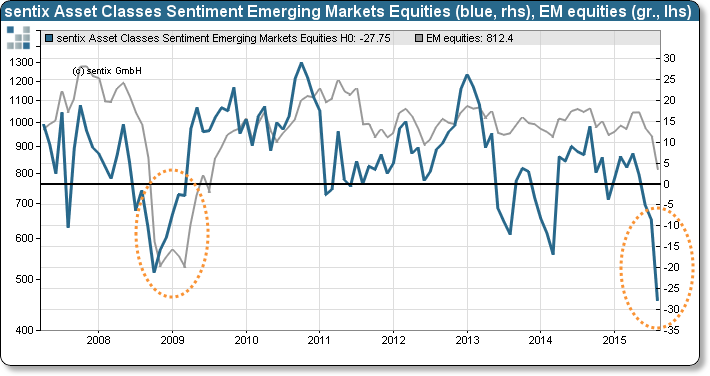

The monthly sentix Sentiment for emerging-markets shares collapses in August. It now stands at its weakest level ever and thus even below its readings from autumn 2008, the time after Lehman Brothers, an investment bank, failed. This is positive, indeed!

sentix Asset Classes Sentiment for emerging-markets equities falls strongly in the current month. It declines by around 20 percentage points and now stands at -27.75 points, an all-time low. Even during the high times of the financial crisis in autumn 2008 the mood among investors for emerging-markets stocks was not as bad as it is today (see graph).

Ever softer commodity prices and sorrows regarding China have led to fears among investors as far as the future performance of equities in the BRIC countries and beyond is concerned. This is an enormous glimmer of hope as the appearance of fear is usually a precursor of a turn in price developments! Consequently, the current sentiment extreme is an interesting buying signal from a medium-term perspective – as shown by the comparable situation around the year’s turn of 2008/09 (see again graph). Bulls and those who still want to become bulls should thus have a closer look, indeed!

Background

sentix Asset Classes Sentiment Emerging Markets Equities is polled among individual and institutional investors since 2007 via the sentix Global Investor Survey. The corresponding survey is open around each third Friday of a month. Investors are asked about their medium-term price expectations for the asset class. These expectations tend to lead price developments as rising preferences signal increasing readiness to buy (and vice versa). Extreme readings of sentix Asset Classes Sentiment indicators often mark the end of a price movement and thus signal increasing chances/ risks.

The current survey was conducted from August 20 to August 22, 2015. 955 individual and institutional investors participated.