|

17 November 2014

Posted in

Special research

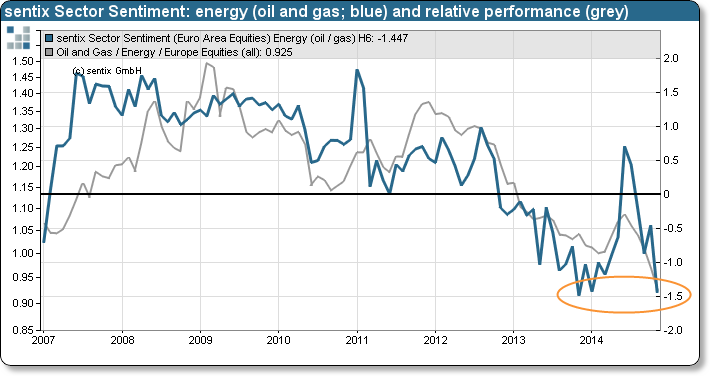

Facing a weak performance, investors lose hope for European energy shares in November: sentix Sector Sentiment for the industry's stocks – polled via the latest sentix Global Investor Survey – drops sharply and now stands close to an all-time low. But this does not automatically mean that the downtrend in the sector's share prices is stopped by now.

This month, sentix Sector Sentiment for European energy (oil and gas) stocks falls by 1.0 to now minus 1.45 standard deviations (see "Background"). Sentiment for the industry is now as bad as it was just once before in the history of the indicator. Only exactly one year ago the index stood a little lower, at minus 1.49 standard deviations (see graph).

From a sentiment point of view such extremely negative readings usually point to a contrarian investment opportunity. But so far, the corresponding charts send a more differentiated message. The price of the sectors' future, for instance, has been rising lately in absolute terms. But its increase has not been more than a pullback to the broken uptrend of the year 2009. Meanwhile, the sector's relative performance has touched a multi-year low recently. Consequently, the charts do not confirm the sentiment's positive signal – at least for the moment.

Slightly more constructive is the picture for crude oil (Brent) per se. The sentix data set here shows that investors' medium-term expectations, their so-called "Strategic Bias", is rising markedly. Meanwhile, the oil price is currently close to an important support of around 78 USD/barrel. A possible positive price move should consequently show up first here – but should then also have positive effects on the energy sector's share prices later on.

Background

sentix Sector sentiment is a monthly survey being conducted since 2002 among individual and institutional investors via the internet. The survey is – since October – run around the second Friday of each month. Investors are asked about their six-month expectations regarding 19 European stocks sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised over all sectors and calculated as so-called z-scores. Z-Scores are standard deviations from the mean of a given sample. A value of +1 for a sector sentiment then means, for instance, that the expectations for the sector stand one standard deviation above the mean expectation for all sectors.

The current sentix Sector Sentiment survey was conducted from November 13 to November 15, 2014. 998 individual and institutional investors took part in it.