|

20 July 2015

Posted in

Special research

sentix Commodities Sentiment collapses in July and reaches a new all-time low. The past has shown that when such a strong fall of the indicator occurs it is not wise to buy the market anti-cyclically. The time for contrarians will come when confidence returns.

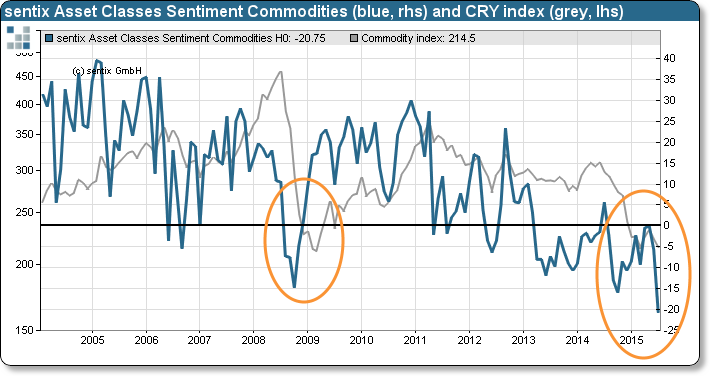

Against the backdrop of falling commodities prices sentix Asset Classes Sentiment for commodities drops by 15 percentage points to -20.75 points, a new all-time low. Even after the collapse of the US investment bank Lehman Brothers in 2008 and also during the strong fall in crude-oil prices in the second half of last year the mood among investors was better than at the current juncture (see graph).

A worsening sentiment cannot only be observed for the asset class of commodities as a whole but also for different of its segments. Further sentix data shows, for instance, that crude-oil sentiment recedes strongly. For gold investors lower their thumbs as well – among market participants the fear emerges that the entire sector is in a free fall. This stance towards commodities leaves its traces in the emerging markets universe, too, for which investors become significantly more cautious. From an anti-cyclical point of view such an extreme pessimism represents a contrarian buying opportunity. But the experiences made in 2008/09 and 2014/15 teach us that here an investment becomes beneficial only after several months (see again graph). One thus can expect more selling to follow until the contrarian effect materialises.

Background

sentix Asset Classes Sentiment Commodities is polled among individual and institutional investors since 2004 via the sentix Global Investor Survey. The corresponding survey is open around each third Friday of a month. Investors are asked about their medium-term price expectations for the asset class of commodities. These expectations tend to lead price developments as rising preferences signal increasing readiness to buy (and vice versa). Extreme readings of sentix Asset Classes Sentiment indicators often mark the end of a price movement and thus signal increasing chances/ risks.

The current survey was conducted from July 16 to July 18, 2015. 986 individual and institutional investors took part in it.