|

16 February 2015

Posted in

Special research

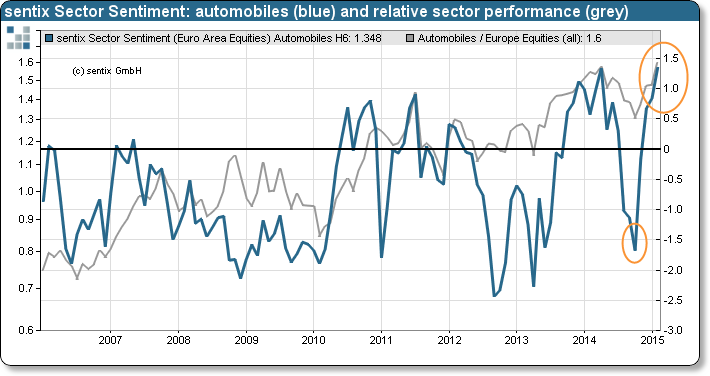

sentix Sector Sentiment for European automobile stocks rises strongly in February and reaches an all-time high. For no other sector investors are equally bullish at the current juncture. As perspectives brighten against the backdrop of a number of positive chart signals we rate the strong development in sentiment as a kick-start signal rather than a contrarian indication.

sentix Sector Sentiment for Europe’s carmakers increases by 0.5 to now 1.35 standard deviations (see „background“). This is a sector-specific record high. Never before in its history (which goes back to 2002) had the indicator climbed to such extreme levels. In addition, sentiment for the European automotive sector is now stronger than for any other sector.

That investors are currently so enthusiastic about auto stocks is also a consequence of their performance. Daimler has just surpassed its 2007 high, BMW even reached an all-time high. Also, the European sector index has marked a record high just at the end of last week. Interestingly, things had still looked completely different back in October (see graph). But since then investors’ economic expectations have improved dramatically and cyclicals thus benefit from strong tailwinds. Furthermore, the weak euro supports the currency unions’ exporters, prominently among them the car-making industry.

Given the numerous positive chart signals we rate the marked improvement in sentiment as a kick-start signal for the sector’s stocks and not – despite the high level of the index – as a contrarian indication. Thus, Europe’s automobile stocks should stay in the fast lane for still some time to come!

Background

sentix Sector sentiment is a monthly survey being conducted since 2002 among individual and institutional investors via the internet. The survey is run around the second Friday of each month. Investors are asked about their six-month expectations regarding 19 European stocks sectors. They can indicate whether they expect a sector to outperform, to perform as the market or to underperform. The survey results are normalised over all sectors and calculated as so-called z-scores. Z-scores are standard deviations from the mean of a given sample. A value of +1 for a sector sentiment means, for instance, that the expectations for the sector stand one standard deviation above the mean expectation for all sectors.

The current sentix Sector Sentiment survey was conducted from February 12 to February 14, 2015. 985 individual and institutional investors took part in it.